Clark Wealth Partners for Dummies

Table of ContentsThe 10-Second Trick For Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedNot known Facts About Clark Wealth PartnersFascination About Clark Wealth PartnersThings about Clark Wealth Partners6 Easy Facts About Clark Wealth Partners DescribedThe Basic Principles Of Clark Wealth Partners

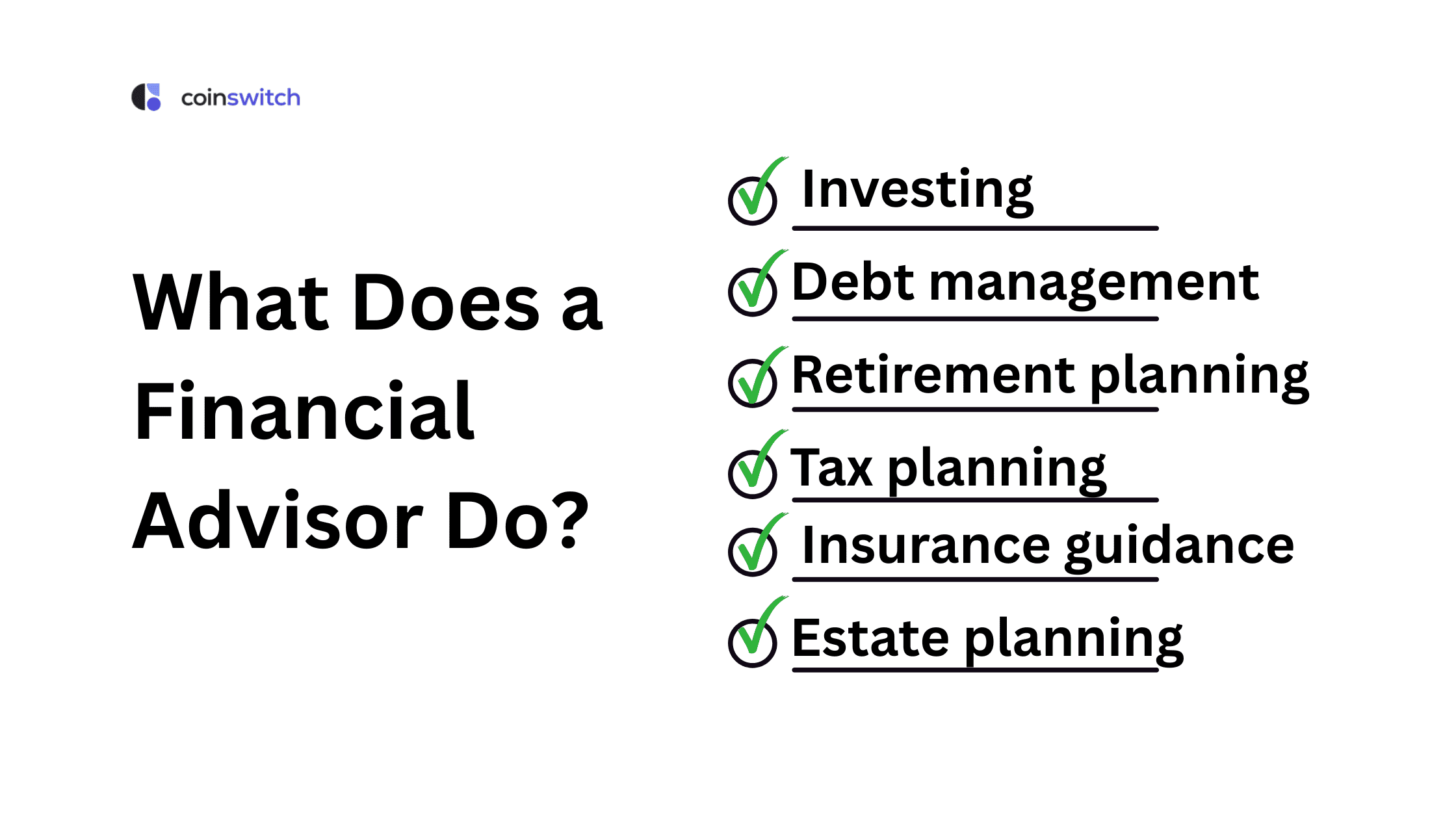

These are specialists who supply financial investment advice and are signed up with the SEC or their state's securities regulator. Financial consultants can likewise specialize, such as in trainee loans, senior requirements, taxes, insurance coverage and various other facets of your finances.Just monetary advisors whose classification needs a fiduciary dutylike qualified financial organizers, for instancecan state the exact same. This distinction additionally means that fiduciary and financial consultant fee frameworks vary also.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

If they are fee-only, they're more likely to be a fiduciary. Lots of qualifications and designations need a fiduciary task.

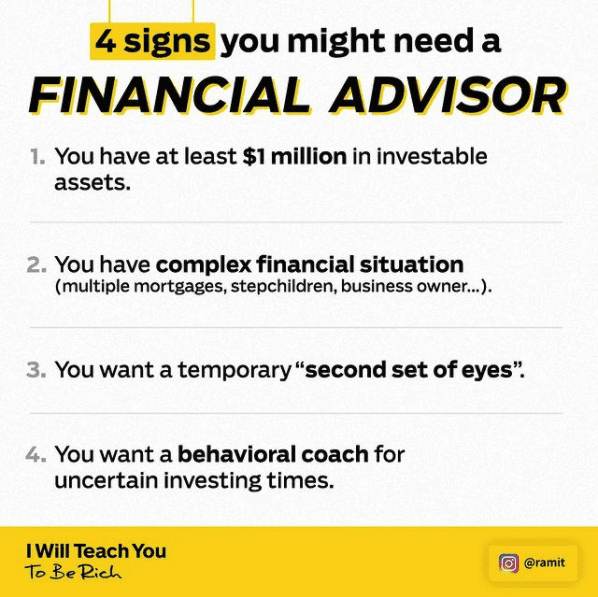

Choosing a fiduciary will guarantee you aren't steered toward certain investments because of the payment they supply - civilian retirement planning. With lots of money on the line, you may desire a financial professional who is legally bound to make use of those funds carefully and just in your benefits. Non-fiduciaries may recommend investment products that are best for their wallets and not your investing goals

Indicators on Clark Wealth Partners You Should Know

Boost in financial savings the typical home saw that functioned with a monetary advisor for 15 years or even more compared to a similar family without a financial advisor. "Extra on the Value of Financial Advisors," CIRANO Job Reports 2020rp-04, CIRANO.

Financial guidance can be useful at transforming factors in your life. When you fulfill with an adviser for the first time, work out what you want to obtain from the recommendations.

The Clark Wealth Partners Ideas

When you've concurred to go in advance, your monetary consultant will prepare a financial plan for you. You should constantly feel comfortable with your advisor and their recommendations.

Firmly insist that you are notified of all transactions, and that you obtain all document pertaining to the account. Your consultant may recommend a managed optional account (MDA) as a way of handling your investments. This involves authorizing a contract (MDA agreement) so they can get or offer investments without having to get in touch with you.

5 Simple Techniques For Clark Wealth Partners

Before you buy an MDA, compare the advantages to the prices and risks. To secure your money: Don't provide your consultant power of lawyer. Never ever authorize an empty paper. Put a time frame on any authority you provide to deal financial investments on your behalf. Urge all correspondence about your investments are sent to you, not just your adviser.

If you're moving to a brand-new consultant, you'll require to arrange to transfer your economic documents to them. If you require help, ask your consultant to clarify the procedure.

To fill their footwear, the country will certainly need more than 100,000 brand-new monetary experts to go into the market.

Our Clark Wealth Partners Statements

Helping individuals attain their monetary objectives is an economic advisor's main function. Yet they are also a small company proprietor, and a section of their time is dedicated to managing their branch office. As the leader of their method, Edward financial planner in ofallon illinois Jones financial consultants require the leadership skills to employ and manage personnel, as well as the service acumen to develop and execute a company method.

Financial consultants invest time every day enjoying or checking out market news on television, online, or in profession magazines. Financial experts with Edward Jones have the benefit of home workplace research study teams that help them keep up to day on supply referrals, mutual fund management, and more. Investing is not a "set it and neglect it" task.

Financial consultants should arrange time every week to satisfy new individuals and overtake the people in their round. The financial services market is greatly regulated, and laws alter commonly - https://form.typeform.com/to/xJ51jype. Lots of independent monetary consultants spend one to 2 hours a day on conformity activities. Edward Jones financial experts are privileged the home workplace does the hefty training for them.

Facts About Clark Wealth Partners Revealed

Edward Jones economic experts are urged to seek additional training to broaden their understanding and abilities. It's additionally a good concept for financial advisors to attend industry seminars.